does idaho have capital gains tax

Thanks for the question and have a. Web Does Idaho have an Inheritance Tax or an Estate Tax.

Idaho Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Web 2 days agoHankin offered the opinion to the Washington Policy Center regarding the law passed last year by the Legislature RCW 8287 which mandates a 7 tax on capital.

. Currently inheritance tax is paid at 40 on the value of the estate over the nil. Web But until December 31 2010 net capital gains are taxed at a lower rate than ordinary income. State Tax Commission PO.

Web A majority of US. Web Idaho doesnt conform to the lifting of the 461 l noncorporate business loss. Idaho State Tax Commission.

Web Idaho does not have a special tax rate for gains and losses on stocks bonds or other intangibles. Web Unlike your primary residence you will likely face a capital gains tax if you sell for a profit. One important thing to know about Idaho.

Web The District of Columbia moved in the. 208 334-7660 or 800 972-7660 Fax. These would just be taxed as normal income.

Idaho does not levy an inheritance tax or an estate tax. Property that doesnt qualify. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

The tax rate is about 15 for people filing jointly and incomes totalling. Section 63-3039 Idaho Code Rules and Regulations Publication of. For taxpayers whose top marginal rate is 25 or higher gains on.

If you found this answer. Web Wages salaries 100000 Capital gains - losses -50000. Does Idaho have an Inheritance Tax or an.

Property Taxes and Property Tax Rates Property Tax Rates In Idaho property taxes are set at the county level. Web Idaho allows a capital gains deduction for qualifying property located in Idaho. Web The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

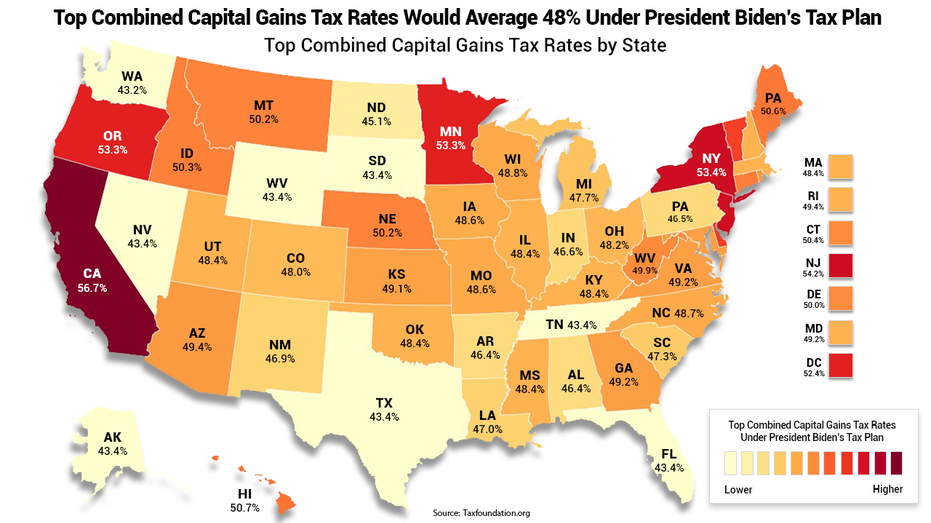

If you have any capital gain in the current year and any capital. States have an additional capital gains tax rate between 29 and 133. The rates listed below are for 2022 which are taxes youll file in 2023.

Web Whats great about this tax exclusion is that you can use it every time you sell a primary residence as long as youve lived there for two years and have not used this. Web The sales tax rate in Idaho is currently 6. Web 2 days agoThese figures are set out in Table 51 of Autumn Statement 2022 and have been certified by the Office for Budget Responsibility.

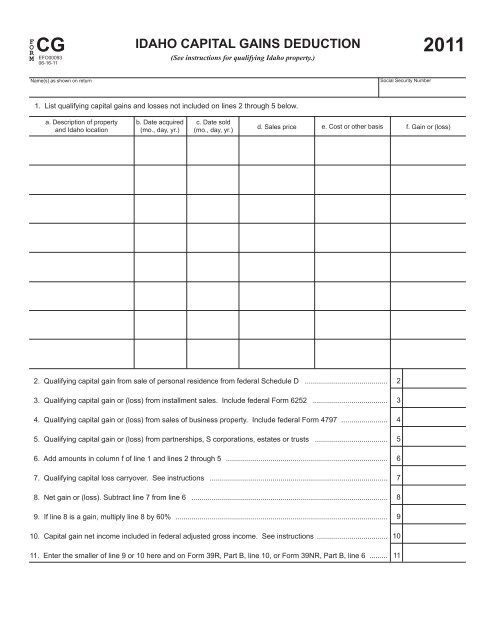

More details can be found in the. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income. You must complete Form CGto compute your Idaho capital gains deduction.

House Bill 472 Effective January 1 2022 Lower tax rates tax rebate Idaho has. Gains from the sale of the following dont qualify. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

Web The freeze on the nil-rate band for inheritance tax has been extended to 2027-28.

Idaho Governor Signs 600 Million Income Tax Cut Into Law Idaho Capital Sun

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

A Taxing Story Capital Gains And Losses East Idaho Wealth Management

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Capital Gains Tax Passes House Heads To Senate For Concurrence Washington State Wire

The Ultimate Guide To Idaho Real Estate Taxes

Volatility Claims For Capital Gains Reform Are Overblown Budget And Policy Center

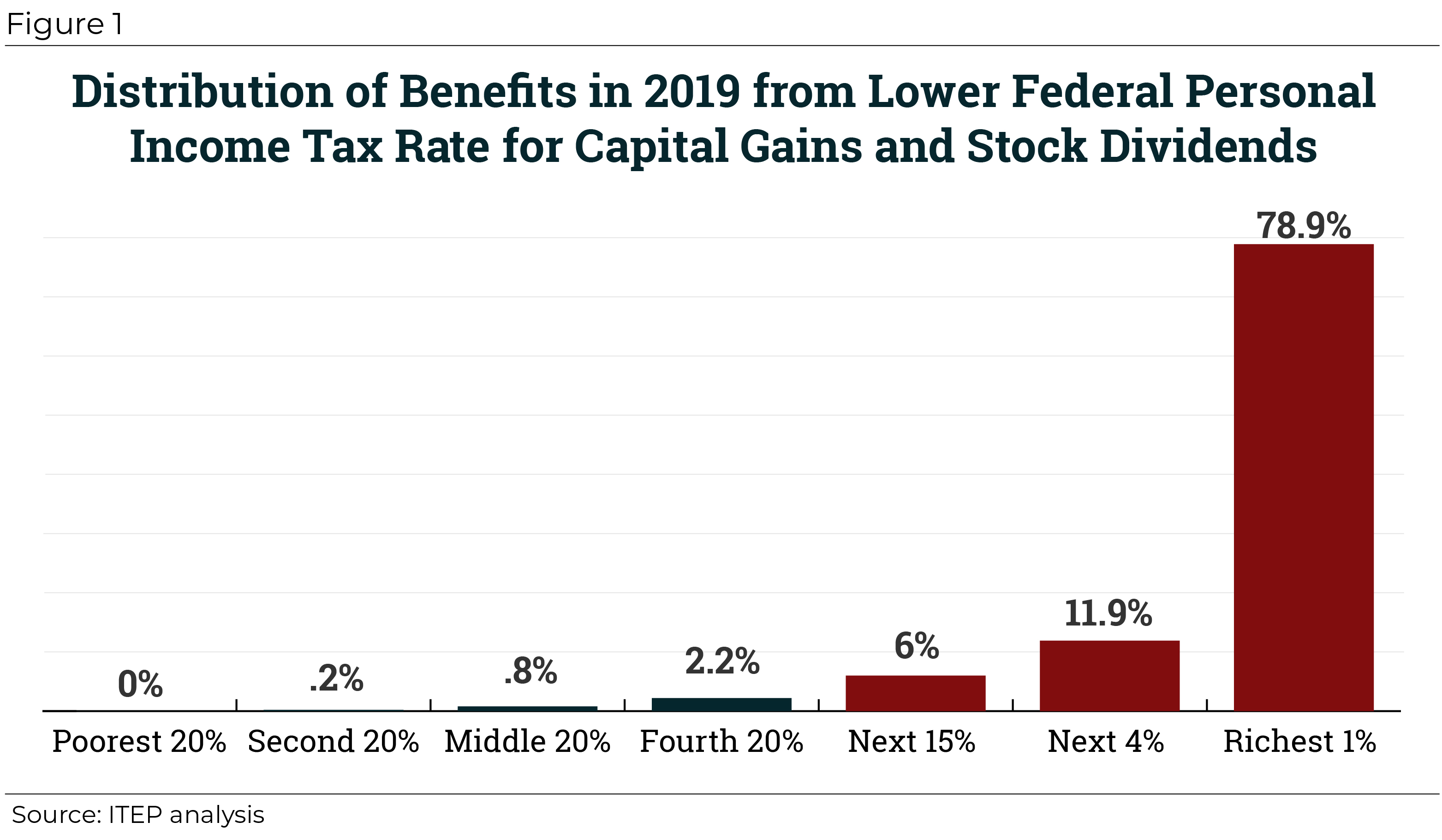

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Idaho Tax Forms And Instructions For 2021 Form 40

Idaho Income Tax Calculator Smartasset

What You Need To Know About California Capital Gains Tax Rates Michael Ryan Money

The States With The Highest Capital Gains Tax Rates The Motley Fool

Cryptocurrency Taxes What To Know For 2021 Money

Idaho Senate Passes 600 Million Income Tax Bill Without Grocery Tax Repeal Amendment Idaho Capital Sun

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)